UX Health Check

I created the UX Health Check as both a product and a service — a psychometric diagnostic designed to evaluate and benchmark user experience quality in financial products. Built as an 8-question framework and deployed through live user testing, the tool helps banks identify behavioral friction points in real user journeys.

It was the first-ever Design-as-a-Service platform Visa built.

Unlike traditional heuristic reviews or opinion-based audits, the UX Health Check combines design psychology with user feedback to surface actionable gaps in usability, trust, loyalty, and appearance.

Created, designed, and developed the tool end-to-end — and applied it to digital products for clients such as First National Bank (SA), Etihad (UAE), Al Rajhi Bank (KSA) and Vodacom (Kenya).

Problem Statements

Digital products often suffer from two problems:

Teams don’t know where the user experience breaks down.

When they do, they don’t know how much it matters.

Existing review processes were subjective, slow, and siloed — resulting in unprioritised design improvements. Clients would often ask us:

“We know something feels off… but what exactly should we fix?”

I built UX Health Check to answer that question — by making UX measurable, comparable, and behaviorally meaningful.

Research

Before creating the tool, I analysed the most common failure points across Visa clients’ products and validated them with both internal VisaNet data and literature in UX psychology.

Then, I tested early prototypes with design teams to find the most economical set of questions that could:

Cover critical UX touchpoints

Map to psychological principles

Be answered quickly in real testing sessions

User Flow Evaluation

Each journey was replicated with interactive mockups, covering flows such as:

Applying for a prepaid card

Loading funds

Viewing card comparisons

Accessing feature descriptions

Users performed actions and then answered the 8-question diagnostic covering:

Usability (e.g. Was the task easy to complete?)

Credibility (e.g. Did the product feel trustworthy and secure?)

Loyalty (e.g. Would you use this product again?)

Appearance (e.g. Did the appearance help or hinder your experience?)

5–8. Additional nuance questions probing confusion, delight, and confidence

Methodology: UX Health Check System

The UX Health Check uses 16 behavioral UX categories, grounded in psychology and cognitive science, to evaluate user journeys across three phases:

Initiate: the first screen and trigger to begin the action

Execute: the steps involved in performing the core task

Post: the confirmation, feedback, and follow-up phase

Each screen is analyzed across the following behavioral dimensions:

Each screen receives a diagnostic score, heatmap analysis (where applicable), and a breakdown of high-impact behavioral opportunities.

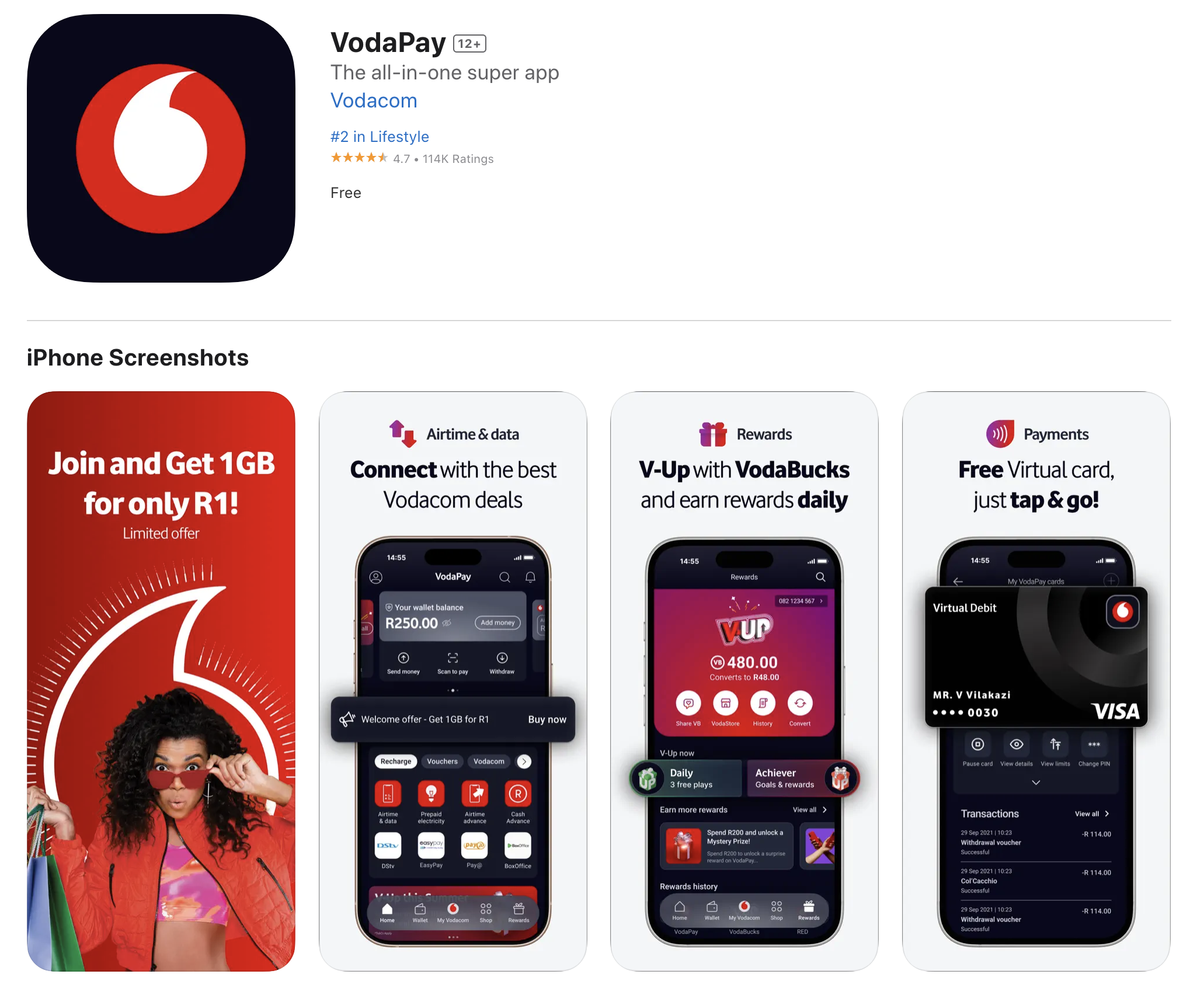

Case Study: Vodapay

Vodacom had launched a digital wallet and virtual card product but was facing significant drop-off during the signup and activation journey.

The internal team suspected friction but lacked a structured way to diagnose what was wrong — and how to fix it.

They asked us:

“How can we increase the number of users completing the virtual card journey — without guessing what to fix?”

We used the UX Health Check to find the exact behavioral points of failure, quantify their impact, and redesign the experience around how users think, not just how products are built.

User Journey Analysis Example

We divided the virtual card journey into three parts based on users’ intent:

INITIATE

Virtual Card Screen

Before (Score: 40%)

No clarity on value proposition

Confusing layout and weak call to action (“Maybe later”)

No explanation of why Vodacom (not a bank) offers cards

Card image felt abstract and untrustworthy

After (Score: 71%)

Clearer card benefits and positioning versus debit card

Motivational framing: “Get your free V-Card”

Authority cues: “Powered by Visa”

Removed optional CTA, used incentives (e.g., V-Rewards)

EXECUTE

Card Setup Screen

Before (Score: 42%)

Validation step was unclear and untimely

No visual cue of journey progress

Feature overload without benefit-driven framing

No personalization options

After (Score: 69%)

Reframed as a short, guided process

Features replaced with benefit framing

Deferred validation step to reduce friction

Optional personalization to increase ownership and attachment

POST

Confirmation and Next Steps:

Steps of the journey following the action

Before (Score: 57%)

Confirmation lacked follow-up actions

No onboarding into “what’s next”

Opportunity to reinforce success was missed

After (Score: 68%)

Added CTA: “Discover your new card”

Triggered confirmation bias: “Want to refer a friend?”

Post-setup personalization options

Visual reinforcement of completion to close psychological loop

Business Impact

Before UX Health Check:

2 key drop-off zones: initiation and validation. Averaging 82% abortion rates

Poor card adoption rates despite technical functionality

After UX Health Check:

Averaging 32% abortion rates

Measurable UX score improvement: 35% → 72%

Redesigned journey

Increased intent and clarity observed in follow-up user tests

Vodacom’s internal product team adopted the UX Health Check as a QA step

My Contribution

Conceived, designed, and developed the UX Health Check as a modular analysis engine. The first Design-as-a-Service product Visa offered to their clients.

Led the behavioural model creation and scoring framework.

Built all diagnostic templates, presentation decks, and feedback reports

Ran the full diagnostic for Vodacom, Etihad, and Al Rajhi, synthesised results, and presented recommendations.

Led the design and product teams responsible for prototyping and improving the journeys we tested.